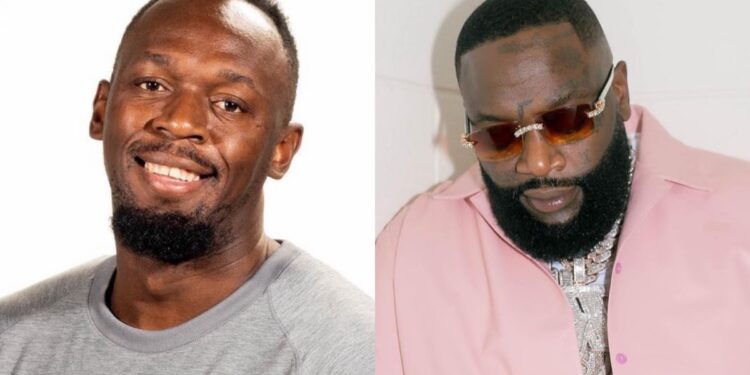

Rick Riss offers Usain Bolt some advice on how to recover $12.7 million stolen from his retirement investment account.

Rick Ross is the latest celebrity to react to news that Usain Bolt has been defrauded by criminals from an investment firm in Kingston, Jamaica. Earlier this month, the sprint legend turned music producer revealed that $12.70 of his retirement investment in SSL Stocks and Securities LLC in 2012 had disappeared. As of the end of December, his account showed only $12,000.

A police investigation has been launched, with several investigative agencies trying to piece together how the company and its employees have operated over the past decade with little or no regular oversight, resulting in the loss of millions of dollars and JMD to dozens of people.

Bolt’s accounts are particularly focused on leaked evidence that the manager under investigation, Jean Ann Panton, almost immediately sold Bolt’s Apple, Amazon, Google and other shares and traded in his Millions of dollars were transferred immediately after investment. The woman is alleged to have acted on the instructions of Bolt’s former manager, Norman Peart, who was fired in December.

Last week, Bolt said Peart was fired and the breakup was not amicable, contrary to what Peart told the media in Jamaica. The world reacted to reports that the sprinter’s money had been stolen, and so far, no one has been held accountable.

As reports surfaced, some members of the hip-hop family commented on the ongoing saga. Among them was Wing Stop boss Rick Ross, who offered advice to Bolt.

“He should have stayed with you until he got your money back,” Rick Ross commented in a news report shared by DJ Akademiks.

Peart has not spoken to the media since the reports surfaced. It’s unclear whether the forms and emails that Panton signed were fake, as she previously claimed she edited the forwarded emails to include instructions investors didn’t give her so she could use their funds and claim them as Own.

Police have yet to arrest anyone in connection with the scandal. Still, the SSL incident was a great embarrassment for the Jamaican government, as the regulator appeared to be failing its job. Meanwhile, Treasurer Nigel Clarke also said he had not read a 2019 report by the regulator that pointed to the business’s risky practices, which included using customers’ savings and investments to pay the daily fee for operations on SSL.

SSL’s directors have denied wrongdoing, and it is unclear whether criminal charges will be brought against them.

Discussion about this post